puerto rico tax break

He decided to try something different. One longstanding Puerto Rico law.

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

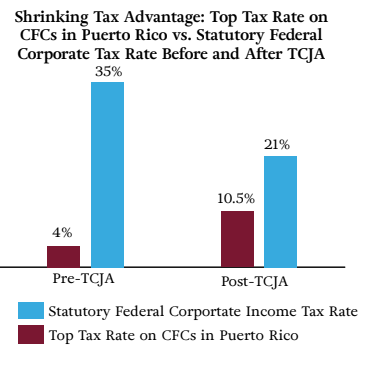

1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future.

. That trend of moving to Puerto Rico for tax incentives has continued even during the pandemic and the number of New York residents relocating to Puerto Rico has quadrupled compared to 2019. If you move to the island you can legally pay none. Move to Puerto Rico.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Commonwealth that answers to the IRS but it has quirky tax rules. Puerto Ricos Act 22 passed in 2012 offers tax breaks to individuals who move to Puerto Rico in hopes of drawing wealthy job creators.

One of those tax breaks enacted in 1976 allowed US. You just have to give. Obviously its a popular idea when people learn about it.

Puerto Rico Offers Huge Tax Breaks and the IRS is Hot On the Trail. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. Enjoy special tax advantages and world-class information technology by relocating your businesss digital marketing activities to Puerto Rico under Act 60.

Move to Puerto Rico. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. In 2019 the tax breaks were repackaged to attract finance tech and.

He decided to try something different. Theres also no capital gains tax. Theres also no capital gains tax.

Payment of taxes to the federal government both personal and corporate is done through the federal Internal Revenue Service while payment of taxes to the Commonwealth government is done through the Puerto Rico. For the right business and if set up properly this can lead to significant tax savings. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island.

Two big tax breaks Puerto Rico is a US. If you move to the island you can legally pay none. Manufacturing companies to avoid corporate income taxes on profits made in US.

You just have to give. Theres also no capital gains tax. You just have to give.

Between March 2020 and February 2021 approximately 82 requests for a permanent move to Puerto Rico were filed by Manhattan residents. The tax break was started by a Puerto Rican politician whod watched years of high taxes fail to improve life on the island. For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000.

He decided to try something different. You just have to give 4 of your income to Puerto Rico. It used to be mostly for companies that would come and set up shop and and be able to pay lower wages than in the US and on top of it not have to pay the.

Puerto Rico has always been a site for speculation and investment on the part of US residents and Wall Street so forever Puerto Rico has been a place where there can be loopholes and ways of really tax dodging. If you move to the island you can legally pay none. And 2 the tax rate is for goods and services produced in PR and sold anywhere in the world including in the US.

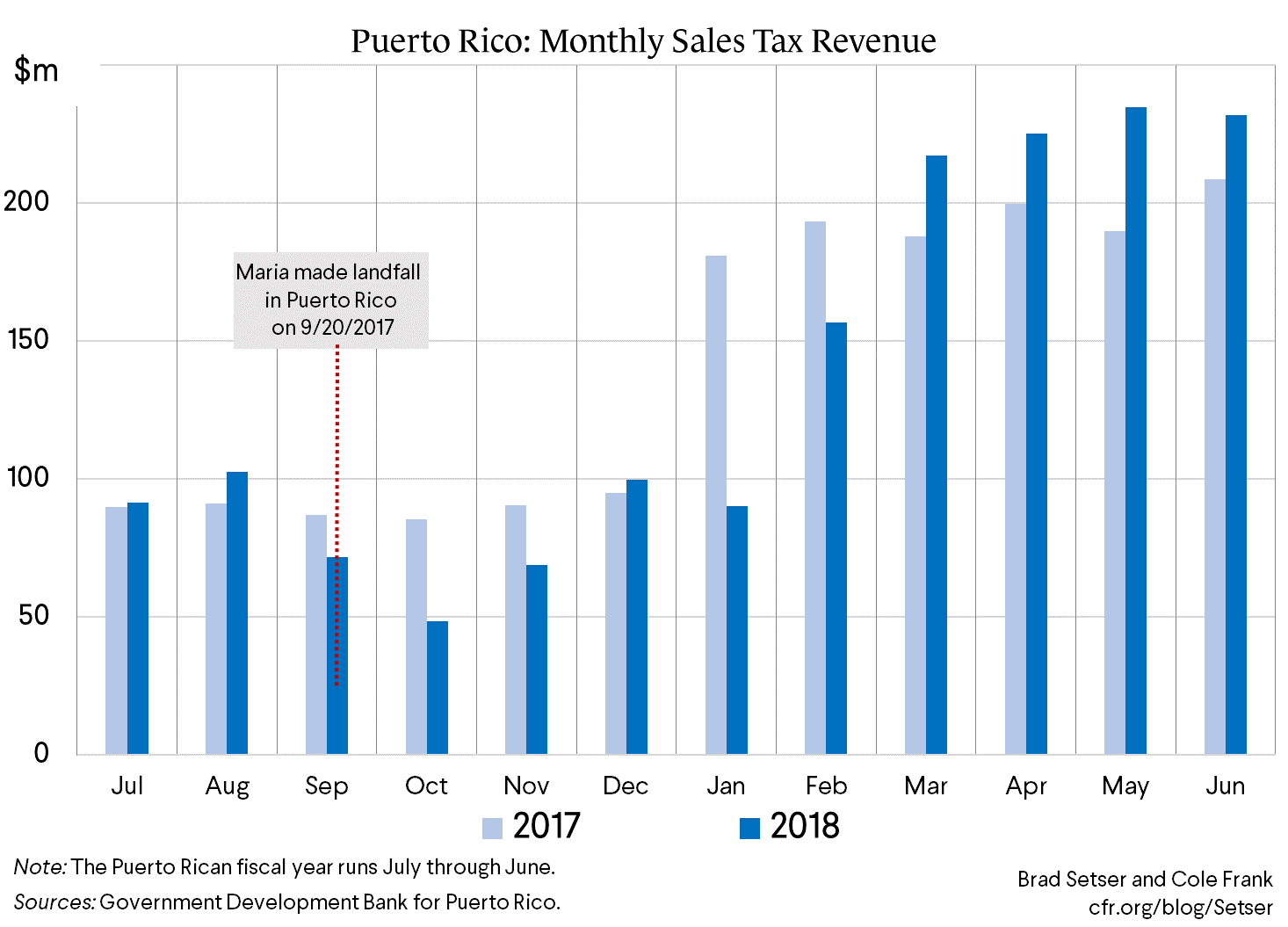

The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors. Move to Puerto Rico. The incentive drew more interest after 2017 when Hurricane Maria decimated the island.

The previous year this. If gross income is USD 100000 or less then the individuals total. Written by Diane Kennedy CPA on June 4 2021.

Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax on capital gains dividends interest and royalties. If you move to the island you can legally pay none. Current temperature in Puerto Rico 85 F.

Tens of thousands have applied for the exemption and applications tripled last year. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Tens of thousands have applied for the exemption and applications tripled last year.

Per capita income in 2020 was less than 33000 according to World Bank data. Theres also no capital gains tax. Tens of thousands have applied for the exemption and applications tripled last year.

Most residents pay no federal income tax. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012. He decided to try something different.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. Territories including Puerto Rico.

Obviously its a popular idea when people learn about it. Move to Puerto Rico. Obviously its a popular idea when people learn about it.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

The Mckinsey Way To Save Puerto Rico

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Why I Really Moved To Puerto Rico And You Should Too Doug Casey S International Man

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Irs To Ultra Rich Looking To Dodge Taxes In Puerto Rico We Re Waiting For You Repeating Islands

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Are Puerto Ricans Being Pushed Out Youtube

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Luring Buyers With Tax Breaks The New York Times